Keeping you and your finances safe during these unusual times is of utmost importance to us. As the Coronavirus COVID-19 pandemic continues to evolve, we want to ensure customers that Fidelity Bank is safe, sound and open for business.

We are here to help customers during these trying times. If you are facing financial hardship due to these unprecedented circumstances, please reach out to your banker to discuss what options may be available to you. It’s all about doing things Right by You. Find your local branch here.

In the meantime, we want to set your mind at ease. Please see the following for our responses to several common questions from our customers.

Q: Can I still come in the branch if I have a need that can’t be handled using the drive-thru?

A: Absolutely! While we are encouraging the use of our drive-thru and Digital Banking tools, we understand that some customers would prefer to come in the branch or have banking needs that require an in-person conversation. If you need to visit with you banker in-person, simply call your local branch to arrange a time that is convenient for you to come by! Our team will be delighted to see you.

You can find your local branch here.

Q: Do I need to have more cash on hand than usual?

A: In this digital age, most personal and business transactions can be done electronically. Services such as Online Banking with Bill Payment, Zelle® and others make it easy to pay businesses or people without cash. However, we understand that having some additional cash on hand may make you feel more at ease. If that is the case, our associates are happy to help. If your cash withdrawal needs are what you would consider to be significantly larger than usual, you may want to call your banker first.

Keep in mind that the safest place for your money is at an FDIC insured bank.

Q: Will Fidelity Bank run out of cash?

A: Fidelity Bank is extremely well capitalized, safe and sound. Additionally, the Fed, which is essentially a bank for banks, has reduced rates which allows banks that need to borrow cash to do so with ease. Customers should rest assured that our Bank has ample cash to meet our customer’s needs.

Q: Is my money safe in the Bank?

A: Yes. Fidelity Bank is safe, sound and well capitalized. We are also FDIC insured. The FDIC insures up to $250,000 per depositor for every FDIC-insured bank. The FDIC has an Electronic Deposit Insurance Estimator (EDIE) tool to help you determine deposit insurance coverage based on your financial scenario.

Q: Does the Bank plan to close?

A: No. Since 1909, Fidelity Bank has focused on what’s important. Our customers. We’ve persevered through wars, the Great Depression, and we will continue to remain strong for our customers today. Learn more about our history here.

Q: Can COVID-19 be transmitted through cash?

A: Experts say that some viruses can survive on surfaces for varying lengths of time. However, there is still a lot to learn about COVID-19, including how long it can survive on surfaces like money. Our suggestion is to follow the recommendations from the Centers for Disease Control (CDC), including washing your hands often and avoid touching your eyes, nose and mouth.

Additionally, some customers are choosing to use their debit and credit cards more frequently, as well as Digital Wallet and Zelle, which allow payments to happen digitally. These are great tools to help you reduce the handling of cash.

Q: Are there any tools to help my business adapt to the new environment?

A: Absolutely! First, if your business is experiencing financial hardship due to these unprecedented circumstances, please reach out to your banker to discuss what options may be available to you. Find your local branch here.

Fidelity Bank also has several tools that can help you manage your business’s finances digitally. Our Business Online Banking allows you to transfer funds, view statements and pay bills electronically. And our Business Mobile Banking app allows you to do all this from your smartphone or tablet, too.

Merchant Services from Fidelity Bank allows businesses to take card payments at point of purchase (including Digital Wallet payments) at your office or from a mobile device. We also have solutions that enable you to take payments online.

Additionally, our Remote Deposit Service helps business customers deposit checks electronically from your office.

Q: Is there any financial relief available to help my business get through these challenging times?

A: Yes. Fidelity Bank wants to work with business customers to help you get through these challenging times. We ask that you reach out to your banker to discuss your specific needs. Find your local branch here.

Beyond Fidelity Bank, there are relief programs that may be able to offer assistance to your business. The U.S. Small Business Administration (SBA) has Coronavirus (COVID-19) Small Business Guidance & Loan Resources to aid small business.

The IRS has established Coronavirus Tax Relief to help those affected.

We suggest contacting your local Chamber of Commerce or other area business support groups to learn more about additional resources that may be available in your area.

If you are negatively affected by the Coronavirus situation, we’re here to help. Our associates are committed to working with our valued customers to reduce financial stress during this challenging and uncertain time. Please contact your local banker to learn more about the options that may be available to you.

We encourage you to use our convenient Digital Banking and Business Mobile Banking services to manage your accounts, check balances, and deposit checks. Automated account information can also be obtained around the clock by calling 1-800-816-9608 or en Español at 1-800-998-9608. For additional customer service, you can also call 1-855-547-1385 weekdays from 8:00 a.m. to 6:00 pm ET.

Fidelity Bank is committed to doing things Right By You.

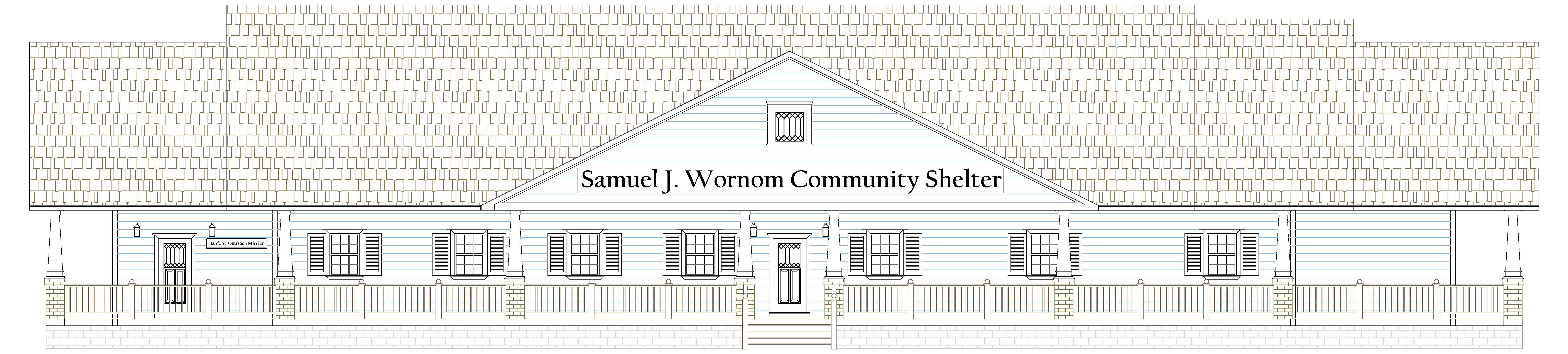

We are pleased to announce that the Federal Home Loan Bank of Atlanta in collaboration with Fidelity Bank has approved $750,000 in funding to support the construction of the new Samuel J. Wornom Community Shelter. The new shelter will be located at 507 South Third Street in Sanford and will house single men, single women, women with children and families.

We are pleased to announce that the Federal Home Loan Bank of Atlanta in collaboration with Fidelity Bank has approved $750,000 in funding to support the construction of the new Samuel J. Wornom Community Shelter. The new shelter will be located at 507 South Third Street in Sanford and will house single men, single women, women with children and families.